Irs Form 2210 Instructions 2025

BlogIrs Form 2210 Instructions 2025. How to fill out irs form 2210. We'll automatically generate form 2210 if your return needs it.

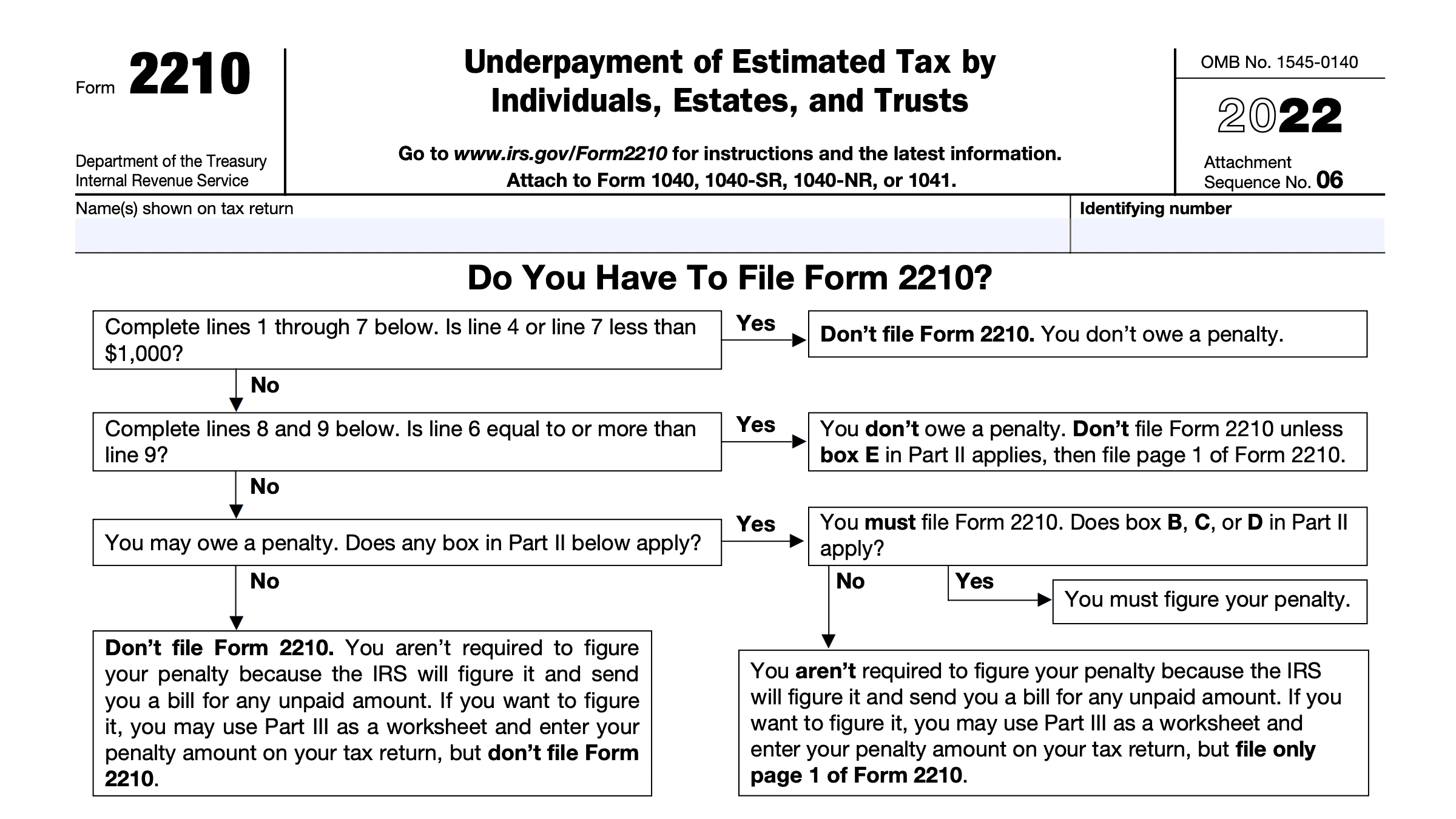

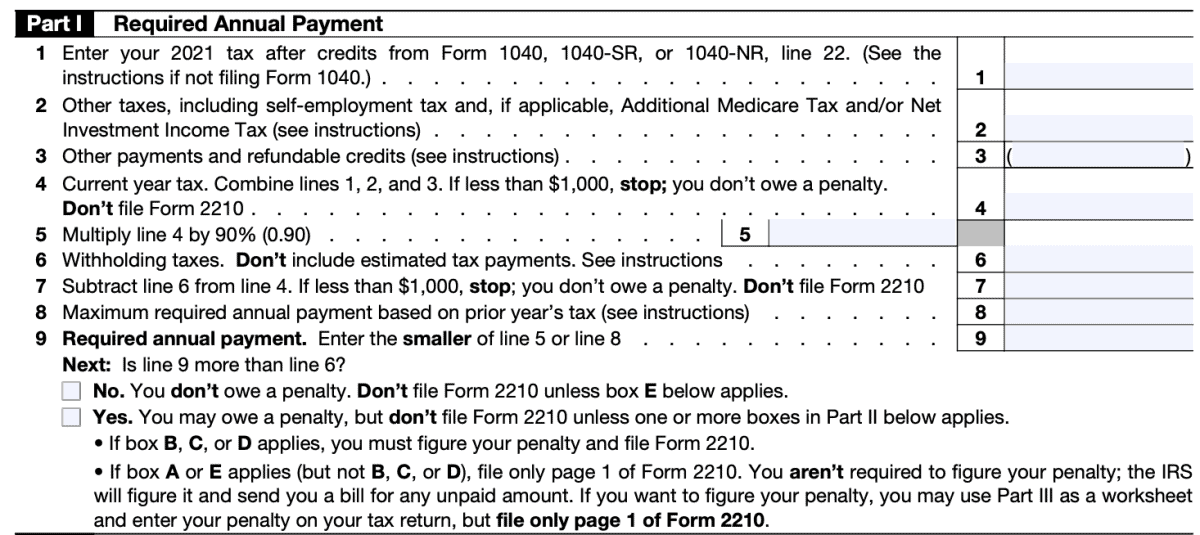

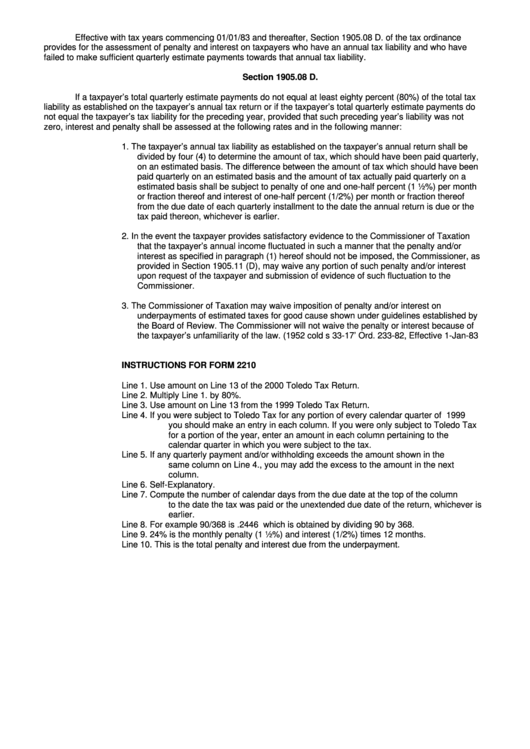

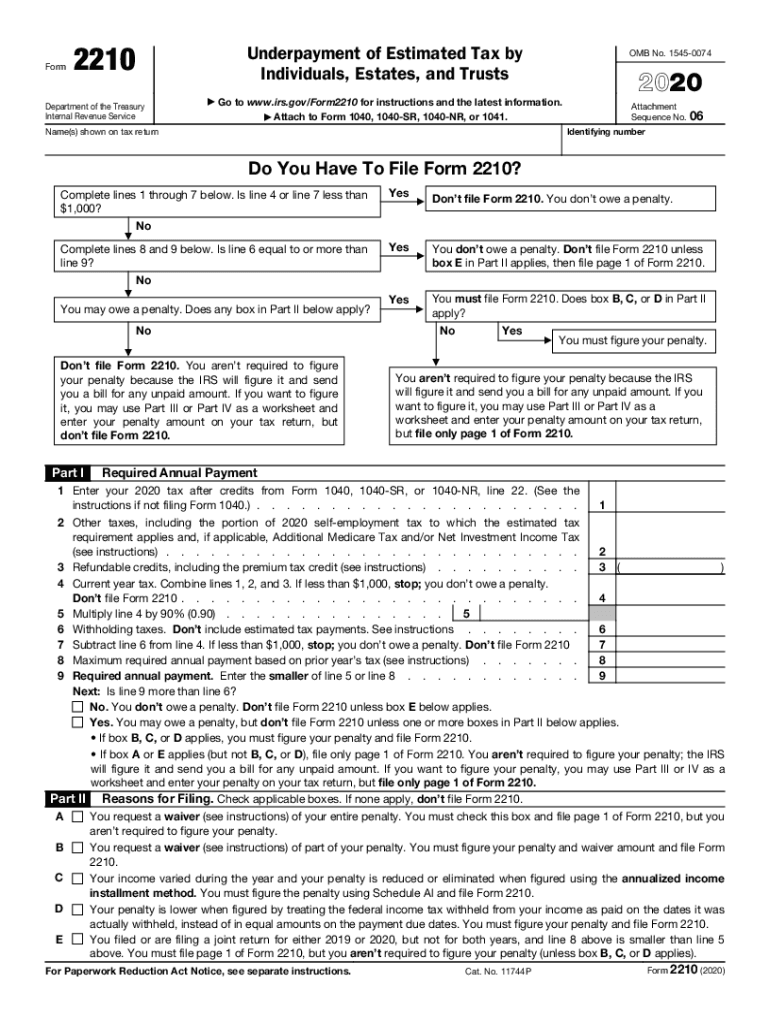

(the irs uses form 2210 to determine the amount of underpayment and the penalty). It’s officially titled “underpayment of estimated tax by individuals, estates, and trusts,” but don’t worry.

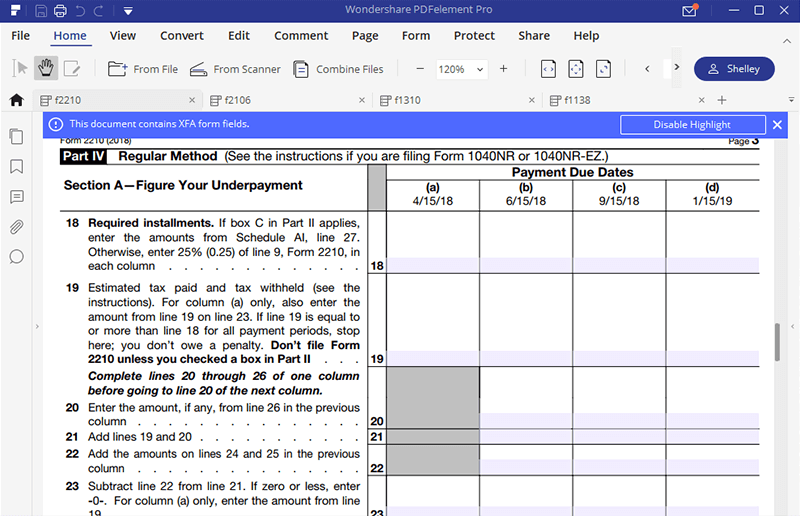

IRS Form 2210 Instructions Underpayment of Estimated Tax, To request relief under the expanded estimated tax penalty waiver, taxpayers who haven’t yet filed their 2018 federal income tax return must attach a. This video briefly walks taxpayers through how to navigate schedule ai on irs form 2210.

IRS Form 2210 Instructions Underpayment of Estimated Tax, The latest versions of irs forms, instructions, and publications. How to fill out irs form 2210.

IRS Form 2210 A Guide to Underpayment of Tax, View more information about using irs forms, instructions, publications and other item files. (the irs uses form 2210 to determine the amount of underpayment and the penalty).

Form 2210 Fill out & sign online DocHub, It’s officially titled “underpayment of estimated tax by individuals, estates, and trusts,” but don’t worry. Taxpayers must account for their income, taxes owed,.

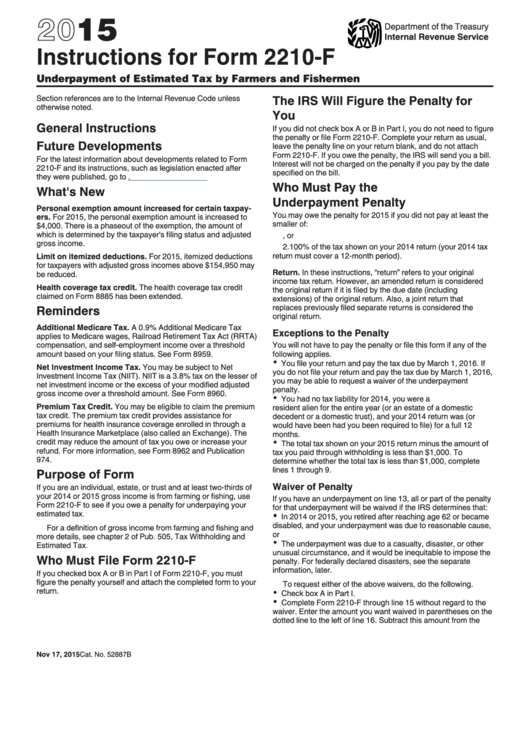

Instructions For Form 2210 Underpayment Of Estimated Tax By, To request relief under the expanded estimated tax penalty waiver, taxpayers who haven’t yet filed their 2018 federal income tax return must attach a. Electronic filing is required for each return reporting and paying tax on 25 or more vehicles that you file during the tax period.

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers, The interest rate for underpayments, which is updated by the irs each quarter; Review the form 2210 instructions for the year you have an estimated tax penalty.

Instructions For Form 2210 Underpayment Of Estimated Tax By, For the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. It’s officially titled “underpayment of estimated tax by individuals, estates, and trusts,” but don’t worry.

Form 2210 Fill out & sign online DocHub, If you're a taxpayer who needs to calculate the penalty for underpayment of estimated tax, irs form 2210 is the document you'll. How to fill out irs form 2210.

IRS Form 2210Fill it with the Best Form Filler, If you owe tax and are filing after the due date. How to fill out irs form 2210 effectively.

Formulário 2210 do IRS Preencher com o melhor preenchedor de formulá, We'll automatically generate form 2210 if your return needs it. This is your 2025 tax, after credits from your tax return.